Inheritance Real Estate Leads

Generally, estate planning aims to avoid the need for probate court intervention. Inherited real estate consists of deeds transferred without judicial intervention. Many heirs do not intend to keep their inherited real estate and wish to sell it quickly. Heirs are generally willing to sell at prices below market value and are motivated sellers. When purchasing real estate, the most crucial part of any real estate transaction is buying at the right price. Inherited real estate leads are valuable to investors seeking to acquire real estate at wholesale pricing.

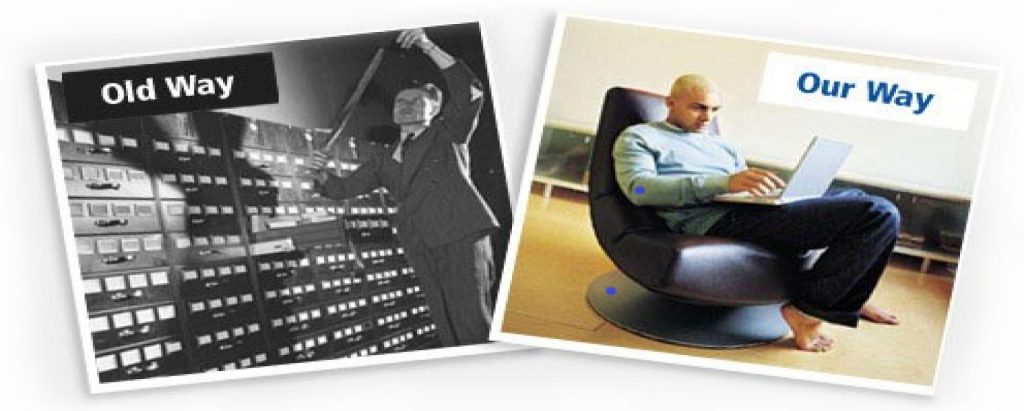

The lower purchase price makes it convenient to obtain financing. Buying at a lower cost increases the possibility of making desirable renovations and reselling the house at a profit. ForeclosuresDaily’s platform will do the footwork for you. All you have to do is focus on the results. Start your Inheritance leads platform today.

Buying Inherited Real Estate at Wholesale Prices

Inherited real estate refers to properties passed down from deceased individuals to their heirs. This type of real estate often presents unique challenges and complexities, primarily because of the emotional and financial considerations involved in transferring ownership. Heirs may find themselves in various situations, such as needing to sell quickly to cover debts or taxes, or simply wanting to liquidate an asset they do not wish to manage. This urgency can create opportunities for investors looking to acquire properties at discounted prices.

Wholesale real estate refers to purchasing properties below market value, often with the intent to resell them at a profit. With inherited real estate, these wholesale deals can be particularly advantageous for investors. Sellers may be overwhelmed by an inherited property and are often willing to accept lower offers to expedite the sale, resulting in substantial savings for buyers prepared to navigate the transaction’s complexities.

Inheritance Real Estate is off the Retail Grid

Inherited real estate typically requires renovation and repairs before being sold for retail purposes. Specifically, houses often have deferred maintenance. Real estate can be a nightmare for heirs, who may not want to make repairs before putting the house on the market. Furthermore, inheritors often need money to make the necessary repairs. In particular, they are usually better off selling their homes as-is to a cash buyer or investor. Buying real estate can be a valuable service to the inheritor and profitable for the investor. Certain real estate investments buck the trend and are the exception when capitalized effectively. Buying houses at the lowest price possible is a recipe for success. ForeclosuresDaily handles all the research so you can focus on becoming more competitive.

Understanding the Potential of Inheritance Leads

Inheritance leads represent a unique and often underutilized segment of the wealth management market. These leads comprise individuals who have recently inherited a significant financial windfall following the passing of a loved one. With this in mind, transition can be an emotional time for many, and they may seek guidance on managing and investing their newfound wealth. For this reason, these leads, investors, and managers can position themselves as trusted allies at a critical moment in their clients’ lives. In particular, many inheritors may feel overwhelmed with the responsibilities of their Inheritance. For example, they might lack the knowledge to manage large sums of money effectively, increasing their likelihood of liquidating quickly. As the baby boomer generation ages, trillions of dollars will change hands in the years to come. A presents a significant opportunity for those who tap into this market.

.

Why Inheritors Want to Sell

The estate is facing financial problems, so it needs to sell quickly. Some inheritors live and work in another state or country and have no plans to return, so they require immediate funds. Most are under time constraints and unable to wait, as well as for unnecessary maintenance expenses and renovations required for a traditional closing. Finally, the odds of being a real estate professional are remote.

Firstly, one of the primary advantages of purchasing inherited real estate at wholesale prices is the potential for significant cost savings. Although inherited properties often carry emotional baggage, heirs often want to sell quickly to alleviate the stress of property management and maintenance. In particular, this urgency can lead to lower selling prices, allowing investors to acquire valuable assets at a fraction of their true market value.

Tips for Inheriting Real Estate Leads

Working with inheritance leads can present several challenges, but understanding these obstacles can help investors navigate the landscape more effectively. An often overlooked point is the emotional turmoil that inheritors may experience. Losing a loved one can overshadow financial discussions, leading to resistance to making financial decisions. Investors must approach these conversations delicately, allowing inheritors to express their grief while gently guiding them to sell the home quickly.

Another challenge is the potential for family dynamics to conflict. Specifically, inheritors may face pressure from siblings or other family members regarding Inheritance, leading to indecision and stress for the primary inheritor. For example, investors are prepared to facilitate discussions and mediate conflicts, helping clients articulate their desires and objectives. In particular, investors can establish themselves as trusted facilitators in a potentially volatile situation by providing a neutral space for these conversations. In the final analysis, equity and capitalization start with a plan to purchase houses for profit.

Benefits of Inheriting Real Estate

Specifically, real estate’s most significant advantage is the double-close strategy, which offers a low entry barrier. Unlike traditional real estate investing, which often requires substantial capital for down payments and closing costs, wholesaling requires little to no money up front. Foreclosures’ daily availability makes them an attractive option for investors looking to enter the wholesale real estate market. For instance, with a strong work ethic, determination, and effective marketing strategies, anyone can begin sourcing deals and building their portfolio with ForeclosuresDaily’s inheritance platform.

Inheritance Real Estate of the Retail Grid

Most inherited real estate requires renovation and repairs, and sells for a profit. Specifically, houses often have deferred maintenance. Real estate can be a nightmare for inheritors, who may not want to make repairs before putting the house on the market. Furthermore, homeowners often need money to make the necessary repairs. Furthermore, Inheritors are usually better off selling their homes as-is to investors. A point often overlooked is that buying real estate can be a valuable service for inheritors. Certain real estate investments buck the trend and are the exception when capitalized effectively. With this in mind, buying houses at the lowest price possible is a recipe for success. ForeclosuresDaily handles all the research so you can focus on becoming more competitive.